by Yafu Zhao, Head of Climate Fintech, New Energy Nexus China.

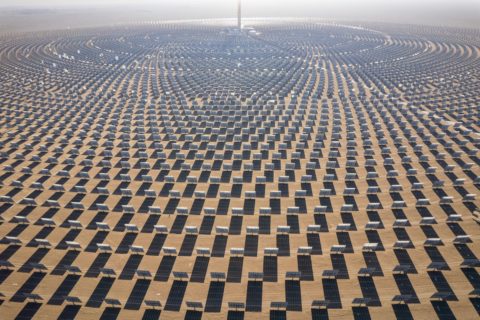

Dunhuang Solar Power Station, Gansu Province, China. (Photo Credit: Darmau Lee)

Spurred by the central government’s 2060 carbon neutrality goal, there has been a rapid increase in distributed renewable energy projects in China, but blockchain tech can help banks unlock even more opportunities.

Distributed solar used to be the most under-banked area of renewable energy, especially for residential solar. For banks, the cost of performing due diligence is high, and they find it challenging to manage and properly measure the risks associated with these projects. For instance, it takes almost the same amount of effort to evaluate a 50kW project compared to a 1MW project because an in-person inspection is usually required. And in addition, banks lack proper tools to control the risks of data manipulation in power generation, which is why many hesitate to finance distributed solar projects and charge higher interest compared to utility scale projects.

Climate fintech, especially blockchain technology, however can go a long way in resolving these challenges. Electricity-generation data, for instance, can be collected by sensors connected to the solar panel, which can then be stored on the blockchain – a decentralized network that ensures the authenticity and immutability of data. Banks can then access this data on a regular basis to measure the performance of these projects, preventing the risk of fraud and saving inspection costs. Such data can also be used should a bank decide to sell its residential solar loan to another financial institution, therefore improving the efficiency of such financial transactions.

Given the booming distributed solar market in China and other parts of the world, we predict that the adoption of blockchain technologies for distributed climate finance will increase in 2022.

In 2021, distributed solar PV represented 53.4% of total installation, which was up from 32.2% in 2020 (source here, in Chinese). Residential solar demonstrated the fastest growth in 2021: 21.5 GW of residential solar was installed, an 115% increase from 2020.

This trend is likely to continue in 2022 for four reasons:

Supply chain carbon data tracking is another factor driving the adoption of blockchain technology. Scope 1 and Scope 2 emissions are low-hanging fruits for carbon emission calculation, but Scope 3 emissions, which includes complex upstream and downstream emission data, require calculation by more advanced technologies [1].

The European Union will impose carbon tariffs on selected carbon-intensive imports from 2026, which means that there is an added urgency for exporters to track carbon emissions in supply chains. In this context blockchain tech will help enhance the traceability, transparency and accountability of carbon emission data, just as it has for distributed renewable energies. For multinational corporations such as Apple and L’Oréal who have pledged to reduce their emissions, blockchain technology will help them monitor carbon emissions in their supply chains. An additional benefit: emission data stored on the blockchain is immutable and transparent, which helps prevent greenwashing in climate finance. Banks can therefore easily identify climate-friendly projects and clearly estimate the impacts of their green loans.

As CEO of Rivtower, Shawn Wang said: “Blockchain can significantly reduce the friction cost of transactions and enhance the efficiency of a sustainable finance network.”. Rivtower is currently providing services for China Merchants Bank (CMB).

Keep an eye on this space if you’re an investor or keenly follow China clean energy and technology space, and reach out if you want to partner with us.

For more information: check out this Webinar with Shawn Wang (in Chinese) with CEO of Rivtower. For more climate fintech stories and applications, please download the New Energy Nexus Climate Fintech Report or contact us at hellochina@newenergynexus.com