How will New Energy Nexus supercharge this clean energy transition?

Our work of finding, funding, and training the entrepreneurs and founding teams of the companies that will run this next phase of the marathon has never been more critical.

Support the entrepreneurs making existing tech even better.

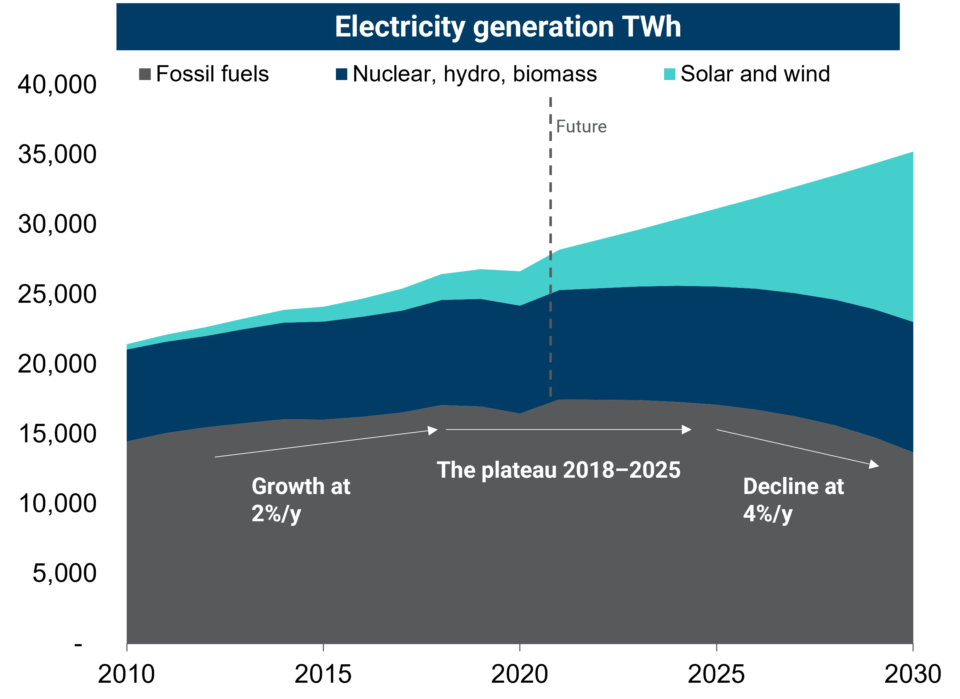

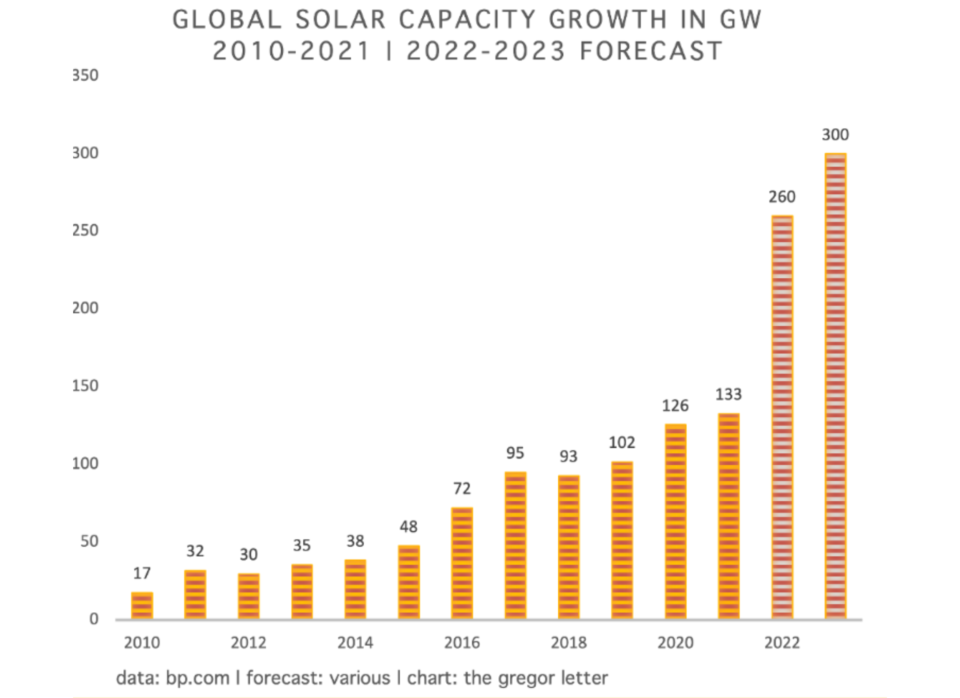

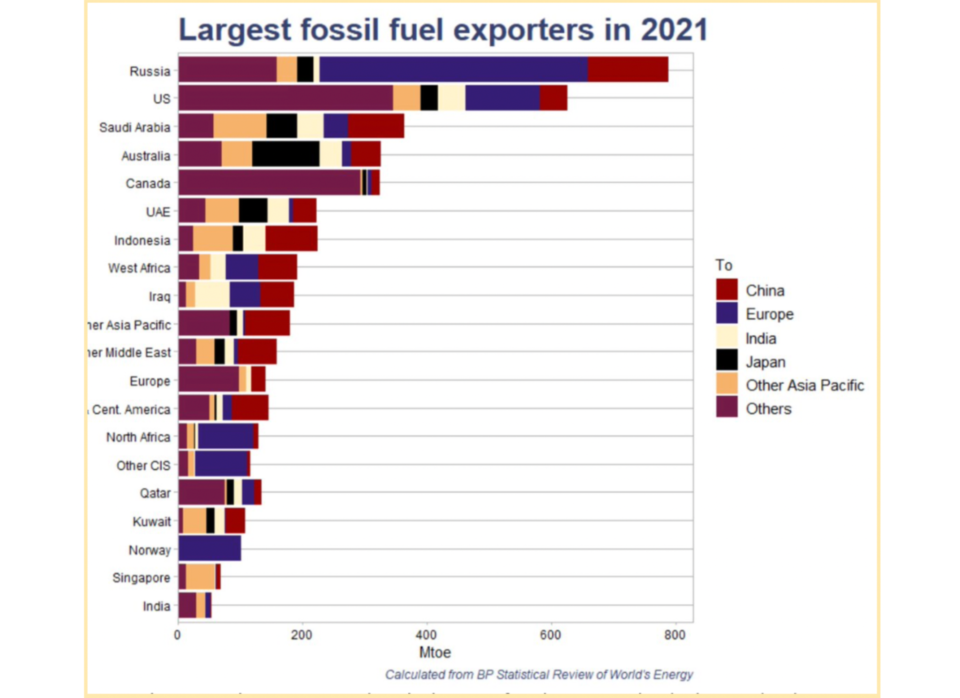

We must improve on the deployment of technologies that are winning the race, so they can achieve their potential ASAP. A “Personal Best” for wind and solar adoption, if you like, is what the world needs, especially in markets where energy demand growth is the greatest. These are the emerging markets of Asia and Africa rather than the declining markets for energy demand growth like Europe, the USA, and Japan. Even China will peak and decline its emissions this decade.

Our NEX Uganda program supports inspiring women who help local women & youth groups to distribute clean energy products in hard to reach areas.

Expand in the markets that matter most.

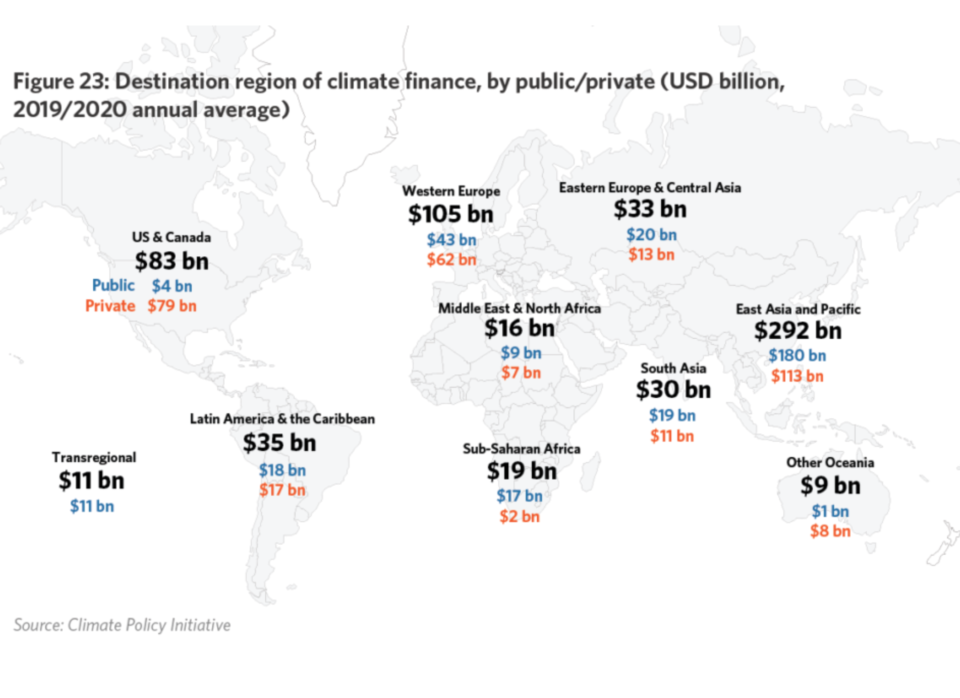

New Energy Nexus needs to become stronger still in Southeast Asia, east and west African countries, as well as India and its neighbors. We need to support the clean energy innovation ecosystems of these countries. And we need to become good at training and supporting grass roots energy access entrepreneurs and those who are driving adoption.

Whereas there are three dozen clean energy incubators and accelerators and over 50 climate tech funds focused on the American market there are but a few in countries like Indonesia and Nigeria. These two nations as examples, may soon be larger than the USA by population and certainly in terms of energy demand growth, most of which is currently planned to come from fossils – coal in the case of Indonesia, diesel in Nigeria.

Less invention, more adoption.

As part of getting good at innovation in the deployment of existing technologies, and scaling the support for entrepreneurs in emerging markets, New Energy Nexus needs to prioritize adoption over invention. As Jigar Shah, the leader of the US Department of Energy’s Loan Program Office likes to say, if a product is not at prototype yet it may not be much use in the climate fight.

We have little time left in the struggle to keep the world to a 1.5 degrees rise and the tools we have now are the ones we will most likely use in the time available. It does not mean new ideas are not welcome (not at all!). Entrepreneurs will need to succeed in bringing insights to market but the new, new thing may not be a technology per se, so much as a way to sell it or a finance product to spread it, or a software to integrate it better into existing infrastructure.

Double down on solar, wind, and batteries.

It is in wind and solar generation that we need ingenuity to be applied and where fortunes may be made. So much innovation is needed to improve energy storage technologies; grid forming and firming power electronics; battery management systems; as well as transmission and distribution. As just one example, New Energy Nexus surfaced a science project that alone could reduce the need for new mining of Lithium by 15% for the same volume of metal through yield engineering improvements in the crushing of spodumene ores in Australia, which contribute over 50% of the raw material. It is in the process flows, components, and circular economy that opportunities for innovation reside.

This is a shift for many of our entrepreneur support organizations, who are seeking unicorn founders with some hail Mary new tech, cut from whole cloth. If one comes along, great, we should back them. And we have specialty programming to surface such solutions in sustainable aviation fuel at Third Derivative or with gas displacement from kitchens in California at CalSEED, but the emphasis of our programs should be spreading the solutions that we’ve got. That will require ingenuity also on our part as well as the diverse entrepreneurs we seek to support. Our teams will go through their own innovation in program design and we expect more new ideas, like digital training for electricians to sell and install solar, to grow in our portfolio of activities.

”The emphasis of our programs should be spreading the solutions that we’ve got.”

Swap Energi’s swappable battery technology lets riders exchange used batteries, helping Indonesia accelerate it’s transition into a clean energy economy.

This is the moment to build a more inclusive and equitable economy.

My last thought for this final stretch as we see the finishing line coming up in the 2030s is that this is our shot to get the economy right. Learning from the mistakes of the fossil fuel era, which lasted about 200 years, we should make sure the next couple of centuries are more just and equitable with less impacts on people and the planet.

The good news is this prospect is at hand in the architecture of distributed energy – the most economic way to build out our solar, wind and battery powered economy is not centralized – and in the nature of our recyclable technologies. All the pieces and parts could be used and recaptured at their end of life and used again – from PV cells to steel and fiberglass in wind turbines to the metals in modern batteries.

Achieving this and building businesses to run this circular economy that maximize benefits to public as well as private interests, with human rights and environmental justice as an outcome baked in from the outset, is the great promise of the energy transition.

New Energy Nexus’ job is to support the folks who will make this happen. We’re also going to build on our work to make access to funding more accessible around the world.

Whereas fossil fuels were necessarily developed at the expense of others, we can make our energy system the driving force of a more equitable and inclusive economy in just a decade or two. I can’t wait. Shine on!