Startups joining the 2024 Climate Fintech Accelerator, a New Energy Nexus China program.

New Energy Nexus China and Yangtze River Delta Hi-Tech Park (Zhaoxiang) offered this year’s Climate Fintech Accelerator—an opportunity for startups to get invaluable mentorship, network, and training that will give them strategic advantages in this competitive space.

These startups from China, Thailand, and Singapore have stepped up to the plate, intent on jumpstarting their growth and driving sustainability at a global scale.

Arkreen

Arkreen is a Web3-powered data network for globally distributed renewable energy resources. They are building a digital infrastructure by utilizing the blockchain and incentivizing climate actors through regenerative financing.

Akreen

CarbonEase

CarbonEase intends to lead the way in end-to-end and inclusive carbon management solutions—focusing on guiding enterprises, particularly in manufacturing, towards carbon neutrality. CarbonEase provides a one-stop low-carbon service package consisting of three modules and eight components. Through the CarbonEasy software as a service (SaaS) platform and a smart manufacturing carbon reduction ecosystem, CarbonEase enables customers to optimize efficiency and energy consumption, effectively reducing costs and carbon emissions.

CarbonEase

CarbonPass

CarbonPass is a digital technology company that empowers international brands to achieve low-carbon international expansion and meet green compliance standards. Utilizing the Internet of Things (IoT), big data, AI, and blockchain, it offers comprehensive carbon neutrality and digital transformation solutions for global brands. With a focus on the sustainable compliance requirements of the ClimeCo Product Certification Program, part of the Amazon Climate Pledge Friendly (CPF) program, CarbonPass has built a digital service system that consists of 52 carbon compliance auditing and certification solutions.

Cero Global Limited

CERO is a personal carbon wallet that tracks carbon footprints with every transaction, converts green efforts into carbon credits seamlessly with the cross-border payment feature embedded, and monitors environmental impact.

DIGICARBON

DIGICARBON is a carbon finance and technology company that specializes in carbon pricing and finance. It provides a range of products integrating hundreds of database indicators and numerous standardized Application Programming Interfaces (API). These tools enable carbon price analysis, asset forecasting, trading, pricing, and more. With an interpretable machine learning analysis framework, DIGICARBON caters to various application scenarios including carbon quotas, sinks, green certificates, and beyond.

DIGICARBON

SusallWave

SusallWave is a fintech firm focused on quantitatively evaluating sustainable development value — which measures if activities contribute to socioeconomic development without exhausting natural resources and incapacitating future generations. Using a green finance data platform based on attributes from various enterprises, it applies assessment models and algorithms in standard construction, quantitative assessment, data application, and technological empowerment. SusallWave offers products and services combining comprehensive data with product innovation; supporting green credit, bonds, supply chain finance, environmental, social, and governance (ESG) funds, and beyond.

SusallWave

Skyco2

Skyco2 helps businesses calculate carbon emissions and manage carbon assets. It provides products such as carbon measurement edge all-in-one machines, digital carbon management and accounting systems, enterprise carbon assets management systems, and greenhouse gas emission accounting standard databases. Serving industries such as industrial, construction, and transportation, Skyco2 also provides MRV services and SaaS solutions. Since 2008, they’ve served clients across 15+ provinces, 100+ cities, and 20,000+ industrial sites.

Skyco2

Tao Tan Lang

Tao Tan Lang, a wholly-owned subsidiary of Treasure Carbon, provides comprehensive digital solutions including these key products: a SaaS carbon management platform, a warrant management system, and a carbon credit rating system. These tools empower enterprises to achieve their environmental objectives and transition towards more sustainable practices.

Tao Tan Lang

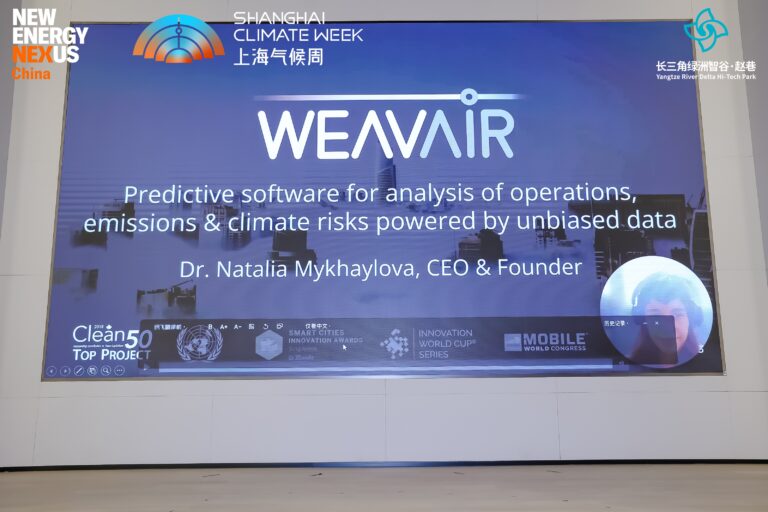

WeavAir

WeavAir offers a digital platform for direct measurement, reporting, and verification of greenhouse gas emissions for more effective ESG investment and energy transition implementation, financing, and insurance. It partners with financial institutions, providing high-quality data for SFDR Article 9 compliance and transparent risk models fueled by satellite data, enhancing analysis resolution by over 70%. Utilizing big data and AI, WeavAir enables real-time ESG risk monitoring of target companies and claims to reduce decision-making time and costs by at least 10-fold. WeavAir analytics helps broaden the investment universe, allows for the design and testing of portfolios, and supports shorter time to market for new funds.

WeavAir

The 2024 Climate Fintech Accelerator is a rolling program and we’re looking forward to receiving applications from all over the world. Apply now and check out more information on our website.