Photo by Cory Mus

The clean energy transition is stalling where it matters most. Emerging markets and developing economies (EMDEs) receive just 20% of global clean energy investment—and only 12% of mitigation finance flows reach EMDEs, excluding China [IEA, 2021; CPI, 2024].

Climate innovation isn’t scarce, but access to capital, coordination, and visibility still are. That’s the reality facing thousands of climate entrepreneurs across the Global South, and it’s the challenge that brought 50 investors, entrepreneurs, ecosystem enablers and policy leaders together at the 2025 Global Climate Finance Forum (GCFF) in Montego Bay, Jamaica.

Hosted in a region that exemplifies both climate vulnerability and entrepreneurial resilience, GCFF was unlike most climate convenings. It wasn’t a stage for panelists; it was a platform for co-creation. Founders from across Asia, Africa, Latin America, and the Caribbean shared how they’re repowering communities, whether through distributed solar, agroforestry, or second-life batteries. Investors listened. And crucially, they rolled up their sleeves to ask: what’s stopping us from backing more of this?

The financing system is still wired for the wrong contexts

Today’s climate finance architecture is not designed to serve the small and growing businesses building climate solutions in high-need, high-potential markets. Less than 15 cents of every climate finance dollar crosses a national border, as host Marilyn Waite mentioned, and just 12% of mitigation finance reaches emerging markets outside of China.

Worse still, clean energy entrepreneurs in the Global South face interest rates as high as 27%, currency swings of 300% or more, and investor mandates that demand “anchor” deals before deployment can even begin. These systemic distortions aren’t just barriers, they’re missed opportunities. And there are entrepreneurs brimming with ideas and already delivering results, from GridAfrica’s distributed energy systems in Zambia, to Swap Energy’s EV battery swapping stations in Bali, to SolarKita’s residential solar expansion across Indonesia.

Limited track records, gaps in financial literacy, and lack of exposure to global capital markets mean they often fall outside traditional investment criteria. And support systems—such as accelerators, impact measurement frameworks, and governance mentoring—are less accessible than for their Global North counterparts. Meanwhile, climate finance ecosystems and policy frameworks often skew toward larger, established firms, leaving SMEs underrepresented on global stages like COP and at investor convenings.

What GCFF made clear: the climate finance system needs rewiring—fast

Participants at GCFF agreed that unlocking finance for climate SMEs demands:

- Locally rooted solutions: The Global South is not a monolith. Funding tools must reflect regional realities and be led by on-the-ground intelligence.

- Targeted catalytic capital: Risk is also not a monolith. Can we break down the components of risk that hold back lenders and investors and apply mitigants to each one to catalyze the overall impact? For example, addressing macroeconomic risks separately from asset risk and project risk, bringing in an anchor in the form of forward revenue contracts, etc.

- Aligning local financial institutions’ capital with SME needs: supporting local financial institutions has the catalytic benefit of transforming local financial systems as well as avoiding the risks that come with foreign capital (eg currency risk). BRAC Bank’s forthcoming private bond issuance will enable them to lend at tenures that match SMEs’ cash flow needs.

- Standardized, flexible frameworks: creating standardized processes and terms and conditions that are also regionally adaptable, so that investors don’t have to reinvent the wheel for each deal.

- Leveraging existing scale and expertise: existing intermediaries like funds, incubators/accelerators, and locally-led thought leaders, have the experience and infrastructure to not only create pools of vetted SMEs to fulfill deal size minimums, but also provide much-needed education and knowledge-sharing for both SMEs and investors.

- Looking for and amplifying the upside: Despite the key role SMEs play in deploying climate solutions and boosting local economic development, there is very little attention given to Global South SMEs on global stages like COP, and even less on the untapped investment opportunities they represent. Something that all of us can do is to continue to amplify the stories of on-the-ground entrepreneurs we encounter and showcase their success stories.

These priorities echo the International Energy Agency’s findings: that unlocking clean energy in developing countries is twice as cost-effective as in advanced economies and requires seven times more investment than they currently receive.

This is where New Energy Nexus is focused

At New Energy Nexus, we have provided that scale and expertise to ease the connection between investors and SMEs. Over our 20-year history, we’ve supported nearly 10,000 entrepreneurs across 12 countries through our locally-led incubators, accelerators and convenings—mobilizing over US$4.7 billion in follow-on investment with just US$84 million in catalytic capital.

Through our Financial Innovation programs, we structure and incubate catalytic structures like the Indonesia Fund I and our EV Guarantee Facility in India, to bring tailored approaches to mobilize private capital into Global South climate ecosystems. Our Financial Innovation focuses on three things:

- Deploy catalytic capital that de-risks early-stage investments and proves the market.

- Design bespoke financial instruments like guarantees and blended finance structures that unlock larger flows.

- Build ecosystems—connecting local banks, accelerators, and government partners to ensure financing tools stick.

What’s next: From conversation to capital

The message from Montego Bay was clear: climate entrepreneurs across the Global South are ready. What they need now is finance that meets them where they are—structured for risk, region, and reality.

As the world moves toward COP30, the priority must be shifting more capital—faster—into the hands of local innovators. That means:

- Expanding catalytic and blended finance to de-risk early-stage solutions

- Supporting local financial intermediaries who understand the context

- Making climate SMEs visible and investable, from term sheets to storytelling

New Energy Nexus is one of many ecosystem actors already building these pathways. But to meet the moment, we need aligned action from funders, governments, and investors willing to back innovation—not just in technology, but in finance itself.

Let’s ensure the next wave of climate finance reaches the people and places where it matters most. Reach out to partner with us!

Jennifer Wang, Director of Financial Innovation at New Energy Nexus

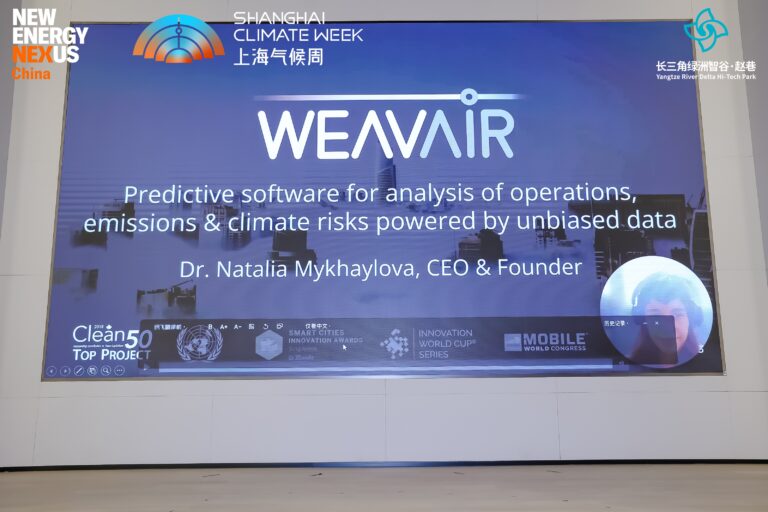

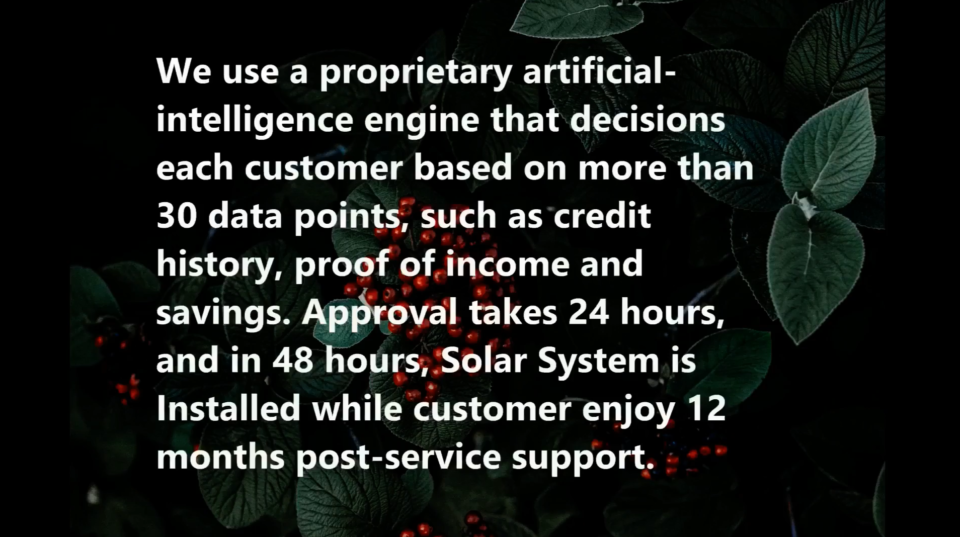

Digital financial technology (known as fintech) has already disrupted the global financial system. Recent improvements to banking, customer experiences, and investment decision-making do not always consider issues such as climate change or energy access, which is why New Energy Nexus is working to foster fintech solutions that can drive 100% clean energy for 100% of the population.

Digital financial technology (known as fintech) has already disrupted the global financial system. Recent improvements to banking, customer experiences, and investment decision-making do not always consider issues such as climate change or energy access, which is why New Energy Nexus is working to foster fintech solutions that can drive 100% clean energy for 100% of the population.

Through the

Through the  Climind

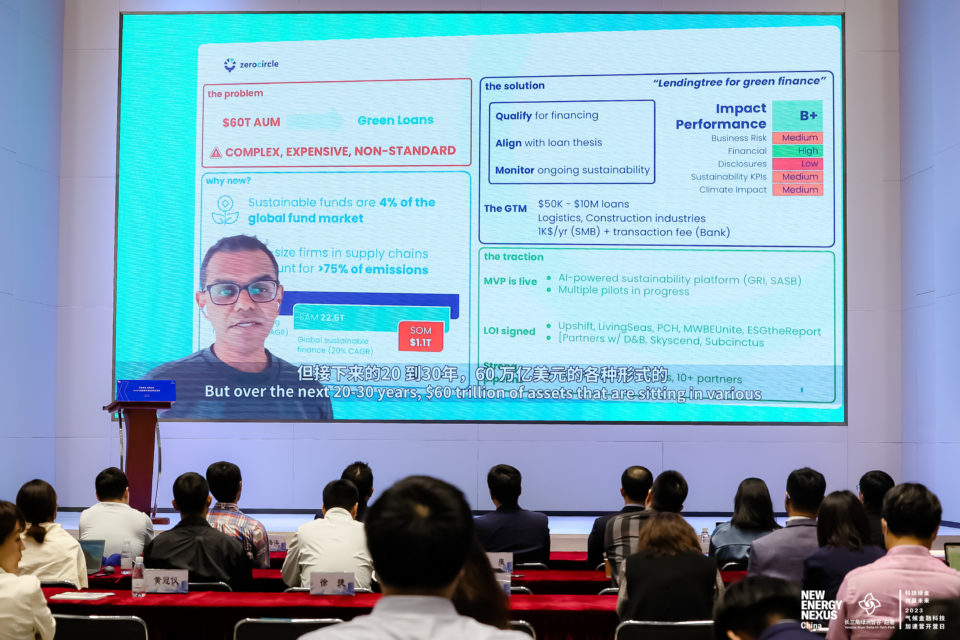

Climind Zero Circle Inc

Zero Circle Inc